-

Posts

4,127 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by The Rover

-

-

Successfully filing my taxes electronically and directly with the IRS, without the use of an outside tax portal.

Also I was glad to take the Schedule M "Making Work Pay" credit !

-

IF Jimmy can tour with Roger .....

THEN Robert can tour with Jethro Tull... Ian can give his voice a rest, and Robert can learn the words to songs like "Mother Goose", Skating Away", "Nothing Is Easy", "Aqualung", and "Locomotive Breath".....

Now....Back to Jimmy & Roger

-

A volcanic cloud from Iceland is being blown over Northern Europe, and has caused the closing of airports.

BBC Live Reports http://news.bbc.co.uk/2/hi/uk_news/8622438.stm

The BBC's transport correspondent Richard Scott says that up to 600,000 travelers across the UK have been stranded because of the flight cancellations.

Caro in Beijing says:

We're supposed to be flying home tomorrow morning but flight cancelled. BA can only offer a flight on the 27th - an extra 11 days! They have seats but won't upgrade us without paying thousands extra and the insurance policy won't pay for an alternative flight. Crazy!

It's not just tourists. British sport has been hit by the volcanic ash cloud. Rugby League Challenge Cup games are in doubt - and the Great Britain Ice Hockey team's trip to Slovenia will only happen if the team spend 26 hours on a bus.

1730 Time to recap. The cloud emitting from the volcano in Iceland is still drifting south-east into Europe. Air traffic has been grounded in the UK until at least 0700 BST Friday - although there is no guarantee that flights will resume then. There will be an update from the national air traffic agency at about 2000 BST.

Elsewhere, the Republic of Ireland has told planes to stay on the runway . France has closed Paris' two airports and about two dozen to the north. Scandinavian nations have also been hit very badly by the cloud, as has northern Russia.

Germany is still assessing the situation - which means that lots of people booked on long-haul flights are considering reaching Frankfurt to make connections. When will it end? Nobody knows. The European air traffic agency says the disruption could last for another 48 hours. So as the UK hunkers down under the volcanic ash cloud, it's a case of waiting to see if the wind changes direction.

1648 Eurocontrol, the air traffic control agency, says that the volcanic cloud could lead to two more days of disruption.

1640 Trivia time. According to the US Geological Survey, it knows of 100 incidents up until 2000 during which an aircraft flew into volcanic ash clouds. In some cases the engines did shut down after sucking in debris - but then successfully restarted once they were clear of the area. So, just to underline that, no fatal incidents that anyone can recall. You can read the fascinating story of what happened to one British Airways jet in 1982 on the Magazine. http://news.bbc.co.uk/2/hi/uk_news/magazine/8622099.stm

1625 All five of the West Midlands' air ambulances have been grounded, with crews redeployed into rapid response cars. They say they are waiting for advice from civil aviation authority.

1612 France says that Paris' two main airports are to close along with almost two dozen more across the north of the closure. The airports will be closed from 2100 GMT.

1609

The BBC's Richard Black says:

This eruption happened underneath a glacier, and the combined power of fire and ice released dust in an explosive plume that soared more than ten kilometres into the atmosphere. But the overall volume of material released is comparatively small. Experts believe the dust will dissipate naturally through the atmosphere, coming down to the Earth's surface gradually. That suggests a minimal impact on human health. The key question is what the volcano does next.

-

Just searched our library and found:

Nothing was found for your search.

Well then.... YOU can make a difference, by donating new, or used Zeppelin CD's and DVD's to your local library.

Over the years, I have personally donated many items to my local library. And some of those items have been Led Zeppelin items. I have donated TSRTS in VHS, and in 2007, in DVD and CD.

I like sharing what I think is good with others, that cannot afford to rent or to buy CDs an DVDs, and are just curious about exploring Led Zeppelin with official documents of their work.

-

So, here it is.... this is the Led Zeppelin collection of music, books, and videos, specifically about Led Zeppelin, that is located in my local public library system. (I did not bother to list if there was more than one copy of each item. Whether the items were checked out or not was not part of what's presented here...)

(I could have also searched side and solo projects, but I chose to just search out Led Zeppelin as the specific topic....)

VHS: None

DVDs:

TSRTS 2007

CDs:

I

II

III

HOTH

PG

ITTOD

CODA

EARLY DAYS

TSRTS 1999

TSRTS 2007

MOTHERSHIP

Rockabye baby!. Lullaby renditions of Led Zeppelin

Author: Armstrong, Michael.

Publisher: Los Angeles, CA :Baby Rock Records,

Pub Year: 2006

Description: 1 sound disc : digital ; 4 3/4 in.

--

The string quartet tribute to Led Zeppelin

Author: Led Zeppelin (Musical group)

Publisher: Los Angeles, CA :Vitamin Records,

Pub Year: 1999

Description: 1 sound disc : digital ; 4 3/4 in. + booklet (2 p.)

--

The ultimate rock album

Author: Led Zeppelin (Musical group)

Publisher: New York :Foundation Records,

Pub Year: 1992

Description: 1 sound disc : digital ; 4 3/4 in. + 1 insert (12 cm.)

--

BOOKS:

Hammer of the gods : the Led Zeppelin saga

Author: Davis, Stephen, 1947-

Publisher: New York :Harper Entertainment,

Pub Year: 2008

Description: 395 p. : ill. ; 21 cm.

ISBN: 0061473081,9780061473081

--

Jimmy Page : magus, musician, man : an unauthorized biography

1st ed.

Author: Case, George, 1967-

Publisher: New York, NY :Hal Leonard,

Pub Year: 2007

Electronic access : Table of contents only

Description: 293 p., [16] p. of plates : ill. (some col.) ; 24 cm.

ISBN: 9781423404071,1423404076

--

Guia musical de Led Zeppelin

(Complete guide to the music of Led Zeppelin in Spanish)

Author: Lewis, Dave, 1956-

Publisher: Mexico, D.F. :Grupo Editorial Tomo,

Pub Year: 2001

Description: ix, 108 p. : ill. ; 23 cm.

ISBN: 9706663533

--

-

-

A great RE-Mix from Supersexy Swingin' Sounds

More Human Than Human (Meet Bambi In The King's Harem Mix)

-

-

Don't know if this band is obscure where you're from, but, here it is anyway:

http://www.youtube.com/watch?v=WzUpVyOdXek

Bloodrock - "D.O.A"

I first heard this song as a teen, on an AM Rock station (they had them back then), in a car, at night.

It was a freaky experience that I have never forgotten to this day.

-

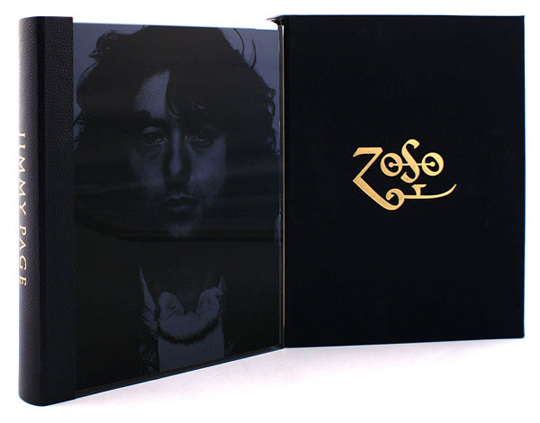

Jimmy Page has officially put pen to paper about his career for the first time in this limited edition.

His words take the form of extended captions, which describe and document pivotal moments and events.

He has also included visas, photos and stamps from his own passports.

Jimmy's own words, combined with his hand-picked photographic selection make this limited edition an historical document and a definitive visual record of a remarkable life of music.

so yeah there will be text

about the o2 footage i think i heard that it was filmed and page has decided not to release it

I think extended captions would be fun to read, especially if they are penned by The Master himself !

(Of course Pro footage of the O2 show exists, it's official release, if ever, is debatable. Too bad there all those monitor glitches.... Maybe if they'd just had another 2 weeks, they could have got those glitches to a minimum !)

-

A think the song Houses Of The Holy would be a good song for people who are not big LED ZEPPELIN fans and would get a lot of request for replay.

I though that's what HHWCID and TRBlues was for ? ? ?

-

Hey guys,

hard to believe that the first Zeppelin show after a long time isn't captured by any bootleggeres...

mut hav been quite a special moment in their career and I would love to listen to it...

Cheers

I'm going to comment w/o 1st reading any of the responses.... because, as special as you might think this performance would or should have been, after a 2 year absence....

1. This was not the original scheduled first date of the tour.... that honor went to Ft. Worth.

2. When Robert got laryngitis, or whatever it was that he picked up in the French Quarter

, just before the tour started... well that delayed the start of the tour for a solid month.

, just before the tour started... well that delayed the start of the tour for a solid month.3. Jimmy did not pick up a guitar for a month, and so the re-scheduled opening date of the tour, in Dallas, on April 1st, was more like a dress rehearsal, than anything else. Simply put... they were "rusty". IF a soundboard, or even a pro recording had been available... I would not even want to listen to it. Was the show that awful?.... By NO Means... it was just not an "A" show, not something worth re-visiting.

Other have said Jimmy was "out of it" for the entire tour ( due to chemicals...).

That is not true.... there were some good nights, and some bad nights, and some very very Good nights.... I happened to see two of them in April of 1977, in Ft. Worth and Houston.... very satisfying shows (whether the boots says so, or not !!!)

-

I thought Page added some nice embellishments to the June 19th San Diego performance.

On the May 26th Cap Center performance, did John Bonham not come in early ?? Rare to hear him blunder !!

I was at the 5/21 show, and ALS was good !!

-

I was listening to some live ALS performances from 1977, on You Tube tinight. The San Diego 5-19-77 performance was particulalry good by Jimmy.

I'm not going to post the You Tube reference here, as it might get looked at and yanked off you tube.... yes, that stuff does happen ! ! ! You'll just have to search for it yourself...

Here'a a You Tube Video labeled ALS that probably won't get yanked, as it's not playing any Zeppelin music.... but the video does have a nice collage of Zeppelin photos.

-

I ordered the collectors edition on Thursday. I am just happy to have gotten one at all as this maybe Pagey's only autobiography. I more interested in what he put in it than what the cover looks like, though I do love that picture from '77.

Other than caption for the photos.... there's not oginh to be a lot of text, right ?

-

From Ross Halfin's Diary Page March 18:

Spent this morning with Jimmy Page finishing off his book. My friend Chris Vranian in LA found some unpublished Arms plus Firm tour photos which were a nice last minute edition. The book is now done - I think. Jimmy, Kazuyo and I watched some of the Led Zeppelin O2 show, which I'd never seen - it was rocking. I didn't enjoy it that much on the night as I was working. The footage of For Your Life and Nobody's Fault was great.

-

Perhaps your bookshelf will look like this someday !

-

Looks Lavish

Love the ZOSO

I may have to get that tattooed on the back of my neck someday

-

Yep, I'll be going to Dallas on the 23rd... The day of my birthday! If I can convince mother dearest.... Oh, the curses of an adolescent.

Or... you could just try going in through the "out" door.

-

Former Federal Reserve Chairman Alan Greenspan on Wednesday testified that mortgage giants Fannie Mae and Freddie Mac played a critical role in fostering an explosion of growth in the subprime-mortgage market that led to the global financial crisis.

Thursday, April 8, 2010

In his first appearance officially defending his own role in the crisis before the Financial Crisis Inquiry Commission, Mr. Greenspan deflected the blame from himself and the central bank - which had broad but largely unused authority to regulate banks and the mortgage market - while giving voice to long-standing charges by Republicans that congressional meddling with Fannie Mae and Freddie Mac was a critical factor in the run-up to the crisis that brought down the global economy in the fall of 2008.

Fannie and Freddie, while under strict federal control since a government takeover in September 2008, have escaped efforts at reform in Congress, though they are fast becoming the biggest beneficiaries of taxpayer bailouts with $125 billion in cash infusions so far. Moreover, their growing and potentially unlimited liabilities are not likely to be recovered through repayments like those from big banks and Wall Street firms in the past year.

In detailing the role of the mortgage monoliths in the crisis, Mr. Greenspan pointed to the mandates Fannie and Freddie received in 2000 from Congress and the Clinton-era Housing and Urban Development Department to make housing more affordable to minorities and people with blemished credit by using their vast resources to purchase more subprime-mortgage securities.

As the mortgage giants started to scarf up the subprime securities, much of which had been engineered by Wall Street firms to earn AAA ratings, the subprime market grew rapidly. It burgeoned from less than 2.5 percent of the mortgage market in 2000 to encompass 40 percent of Fannie's and Freddie's more than $5 trillion mortgage portfolios by 2004, Mr. Greenspan said.

The enormous appetite for subprime mortgages that Fannie and Freddie brought to the market is the reason that interest rates on mortgages fell so dramatically in the mid-2000s and many exotic and risky loans were created to satisfy the heightened demand for mortgage investments, Mr. Greenspan said. That, in turn, gave birth to the most abusive loans with low initial "teaser" rates and no requirements for down payments or income documentation.

"A significant proportion of the increased demand for subprime-mortgage-backed securities during the years 2003 to 2004 was effectively politically mandated," he said, adding that the full extent of the mortgage enterprises' investments in risky loans was not known until September, when a large portion of what had been classified as "prime" mortgages in their portfolios was revealed to be subprime.

While much of the riskiest subprime securities were purchased directly from Wall Street by European investment funds drawn by high yields and low default rates during the housing boom, Fannie and Freddie proved to be the best conduit for rapidly growing demand from more conservative investors in Asia for U.S. mortgage investments.

Fannie and Freddie first issued their own debt, which had an implicit government guarantee that appealed to the Asian investors, and then used the cash to invest in subprime loans, in a process that Mr. Greenspan often criticized at the time as over-acquisitiveness aimed at dominating the mortgage market.

"The subprime market grew rapidly in response," he said, and "subprime loan standards deteriorated rapidly," worsening an investment bubble that was already developing in the housing market.

Mr. Greenspan, whose views are still closely followed in financial markets though he left the Fed more than four years ago, spurned repeated assertions by members of the commission that the Fed's own low interest rate policies in 2003 were what nurtured the housing bubble.

"The house-price bubble, the most prominent global bubble in generations, was engendered by low interest rates," he said, but "it was long-term rates that galvanized prices, not the overnight rates of central banks." Long-term rates are largely set in global financial markets and reflect investors' demand for Treasury bonds and competing instruments, such as Fannie and Freddie mortgage bonds.

As the housing bubble was building in the mid-2000s, Mr. Greenspan frequently noted a "conundrum" that long-term rates were inexplicably low, did not seem to reflect the increasing risks of bond investments and had become divorced from their traditional linkage to short-term rates, which the Fed started to raise in 2004.

Mr. Greenspan theorized that the big drop in long-term rates was the result of enormous cash surpluses being amassed by China and other East Asian countries from their earnings on foreign trade, much of which was invested in U.S. Treasury bonds and mortgage securities, drawing down long-term rates. His analysis is widely viewed as correct today in pinpointing a key cause of the housing bubble.

Mr. Greenspan's prescience on such matters lends credibility to his testimony. But the former Fed chairman continued to largely reject charges that he personally played a critical role in the run-up to the crisis by not using the Fed's regulatory authority to set standards for subprime lending while frequently urging Congress not to regulate the complex and fast-growing markets for derivative securities such as credit default swaps in the 1990s.

Mr. Greenspan acknowledged he made "an awful lot of mistakes" in his 21 years in office, though he claimed to be right about 70 percent of the time.

He said that credit default swaps, a kind of insurance on risky mortgages that played a pivotal role in bringing down Lehman Brothers Holdings Inc. and American International Group Inc. in the September 2008 events that triggered the global crisis, were only a tiny share of the derivatives markets when he cautioned against regulation in the late 1990s and were not of much concern to regulators at the time.

"We did not see the risks until after the Lehman bankruptcy," when the unraveling of derivatives contracts contributed to the collapse in the economy and markets worldwide, he said. After the debacle, he said, it became clear the derivatives markets and the whole financial system were drastically undercapitalized and that the principal response by government should be to substantially increase the capital and liquidity requirements of all globally operating financial firms.

Mr. Greenspan's successor, Fed Chairman Ben S. Bernanke, remarked separately in a speech to a Dallas business group Wednesday that while the worst of the debacle is over, "We are far from being out of the woods. Many Americans are still grappling with unemployment or foreclosure or both."

http://www.washingtontimes.com/news/2010/apr/08/greenspan-links-fannie-freddie-to-crisis/

-

When it came to "meets and greets" Robert & Jimmy were prodigious.

They were indigenous to "meets and greets".

Origin:

1640–50; < L indigen(a) native, original inhabitant (indi-, by-form of in- in-2 (cf. indagate) + -gena, deriv. from base of gignere to bring into being; cf. genital, genitor) + -ous

-

Alice In Chains!!!

... the only good things from the 90's IMO.

Uhhh, I would add White Zombie to that list.

My favorite AIC is WOULD?

-

-

Oh yes, there is Classic Rock around here.... But, I am careful not to tune it in, that is the over played crap of the Universe station....

I would recommend using an internet portal to find great rock music to listen to.

Such as Radio Time

UK Politics ~~ "New" Labour / Liberal Democrat / Conservative

in Ramble On

Posted

Nick Clegg, David Cameron and Gordon Brown clash on live TV over MPs' expenses

http://news.bbc.co.uk/2/hi/uk_news/politics/election_2010/8621119.stm

Full Transcript of the 1st Debate